Editor’s Be aware: Join CNN’s Meanwhile in China newsletter which explores what you’ll want to know concerning the nation’s rise and the way it impacts the world.

Hong Kong

CNN

—

A “life and loss of life race” has begun to unfold on the planet’s largest marketplace for electrical automobiles (EV).

Chinese language EV makers exhibiting off their latest fashions at Auto China, which kicks off in Beijing on Thursday, have loved beneficiant assist from the federal government for years, with some rising quickly to turn into world gamers. BYD, for instance, is now vying with Tesla for management of the battery electrical automobile market.

However the entire nation’s greater than 200 EV producers at the moment are grappling with big oversupply, and consultants predict many smaller firms won’t survive the fiercely-competitive atmosphere.

From a brutal worth struggle to slowing gross sales in a weakening economy, the challenges unfolding in China have additionally compelled some world automakers to retreat. And, it doesn’t assist that the keenness for EVs is waning in different markets world wide.

“China’s EV trade is simply going to go from power to power as a complete, however not each participant immediately will see the end line,” mentioned Mark Rainford, an automotive trade commentator based mostly in Shanghai who hosts the YouTube channel “Inside China Auto.”

Even Chinese language officers have mentioned that carmakers will want a forged iron abdomen to drag by the following few months.

“Competitors within the new power automobile (NEV) trade can be extraordinarily fierce in 2024,” the Nationwide Improvement and Reform Fee (NDRC), the nation’s prime financial planner, mentioned on Monday.

Greater than a dozen passenger carmakers disappeared from the market final yr, in keeping with statistics from the China Passenger Automotive Affiliation. These embody once-popular EV manufacturers, reminiscent of WM Motor, Byton, Aiways, and Levdeo.

Some world automakers have additionally needed to restructure their companies or shut down operations. In October, Mitsubishi Motors announced it will finish manufacturing of its vehicles at its three way partnership in China. Honda (HMC), Hyundai and Ford (F) have additionally taken steps, together with layoffs and manufacturing facility gross sales, to chop prices, in keeping with stock exchange filings and state media reports.

By 2030, China may have fewer than 5 main EV gamers, Richard Yu, CEO of Huawei’s client enterprise division, predicted final June. Huawei has fashioned partnerships with a number of automakers to produce EVs.

So what makes the trade so troublesome for each native and international gamers, and what’s forward for EV makers on the planet’s second largest economic system?

Aggressive worth cuts are a serious headache.

The value struggle kicked off in October 2022, when Tesla (TSLA) slashed costs for its Mannequin 3 and Mannequin Y vehicles in China by as a lot as 9%. Three months later, it discounted its vehicles once more, triggering a wave of worth cuts that engulfed the nation’s auto trade in 2023, together with gasoline automotive producers.

The stress simply turned much more intense.

Simply this week, Tesla as soon as once more minimize the beginning costs of 4 fashions offered in mainland China, its largest abroad market, by 14,000 yuan ($1,932). Xpeng and Li Auto, China’s quickest rising automotive manufacturers, instantly followed suit, providing steep reductions or tens of thousands and thousands of {dollars} in subsidies to draw consumers.

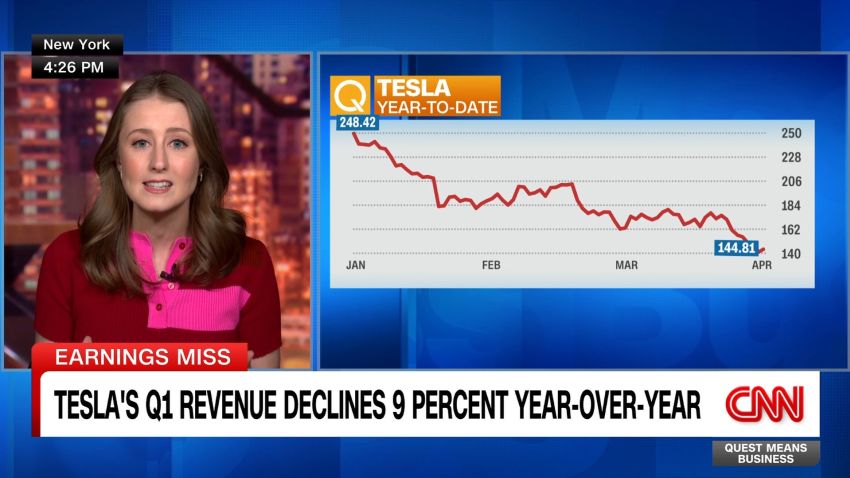

Tesla experiences sharp drop in income

“The value struggle is more likely to rage on additional into this yr, although it’s arduous to think about costs can come down a lot additional than they have already got,” mentioned Rainford.

The offers accessible to Chinese language automotive consumers at the moment are very engaging, however some manufacturers will be unable to maintain these reductions endlessly, he mentioned.

“They’re going to wish deep pockets and good advertising to take sufficient enterprise,” he added.

The value cuts have squeezed profitability. In 2023, the common revenue margin for China’s auto trade slid to five%, the bottom stage in at the least a decade, in keeping with knowledge from the China Affiliation of Auto Producers (CAAM).

Overcrowding is one other main concern plaguing China’s EV trade.

The NDRC expects greater than 110 new NEV fashions to be launched this yr, including to a flood of EVs hitting the market.

For 2024, BYD, Huawei’s Aito and Li Auto alone are planning to extend deliveries by 2.3 million automobiles, the NDRC mentioned. However the whole market demand is forecast to extend by solely 2.1 million vehicles.

“The market can be in a state of oversupply for a very long time,” it added.

And now, extra firms are becoming a member of the overcrowded subject.

Final month, Xiaomi, a Chinese language smartphone model, launched its electrical automotive, the SU7 sedan. CEO Lei Jun mentioned he desires to tackle Tesla and Porsche with the brand new premium automotive that comes with a beginning worth of simply 215,900 yuan ($29,794).

Final November, Meizu, one other smartphone maker, announced it will companion with Geely Auto and launch its first EV, Meizu DreamCar MX, in 2024.

The identical month, Huawei launched its first electric sedan, the Luxeed S7, co-developed with Chery Auto with a view to taking over Tesla’s Mannequin S.

The CAAM has forecast the nation’s whole passenger vehicles gross sales can be round 26.8 million automobiles for 2024. However the mixed gross sales targets by main producers have to this point reached practically 30 million items.

That oversupply means firms want to hurry up gross sales, together with by boosting exports — on the threat of elevating tensions with key buying and selling companions. Failure to take action might trigger money circulate issues and plunge the producers into disaster.

And the battle might get more durable for international gamers.

Tesla was briefly dethroned by BYD because the world’s bestselling EV model within the fourth quarter of final yr. BYD’s entry-level mannequin sells in China for the equal of just under $10,000. In distinction, Tesla’s Mannequin 3, its most cost-effective mannequin, at present prices at the least 231,900 yuan ($32,002) after the newest worth minimize.

“The standard of the merchandise now, mixed with the unparalleled ranges of automation and innovation going into Chinese language vehicles, means it’s the normal international gamers who can be feeling the stress rising as extra Chinese language manufacturers show their wares in worldwide markets,” Rainford mentioned.

As competitors turns into extra intense, many carmakers will perish within the coming months, in keeping with China’s EV firm CEOs.

“Getting into 2024, the knockout spherical of China’s auto trade will start in an all-round approach, and the trade will enter a interval of consolidation, with an entire reshuffle,” mentioned Gan Jiayue, chief govt officer of Geely Auto, on the firm’s earnings convention in March.

Wang Chuanfu, chairman of BYD, additionally predicted in March {that a} “brutal elimination spherical” is coming.

“China’s EV trade has entered a stage of cyclical adjustment after 20 years of progress,” he mentioned at a discussion board in Beijing. “Firms should type economies of scale and model benefits as quickly as potential.”

Additional consolidation of the trade means extra small-to-medium-sized firms might be worn out, trade insiders predict.

Based on Yin Tongyue, chairman of Chery Auto, EV makers are getting into a “life and loss of life race.” He added final month that his firm would roll out 39 new pure electrical and hybrid fashions in 2024 and 2025 to realize a prime place within the EV market.

However for those who survive, the long run isn’t completely bleak.

In 2024, the market share of electrical vehicles may attain as much as 45% in China, underpinned by competitors amongst producers, falling battery and automotive costs and ongoing coverage assist, according to the Worldwide Vitality Company.